Riding the Tides with Old Money

My dears, Bank of America’s 2024 campaign concluded not with a bang but a firm curtsy. A $27.1 billion net income on over $100 billion in revenue is nothing to sneeze at, particularly when one’s expense ledger shows the sort of disciplined grooming that would make even the fussiest butler nod with approval. Operational Excellence, they call it—though I call it plain old good housekeeping.

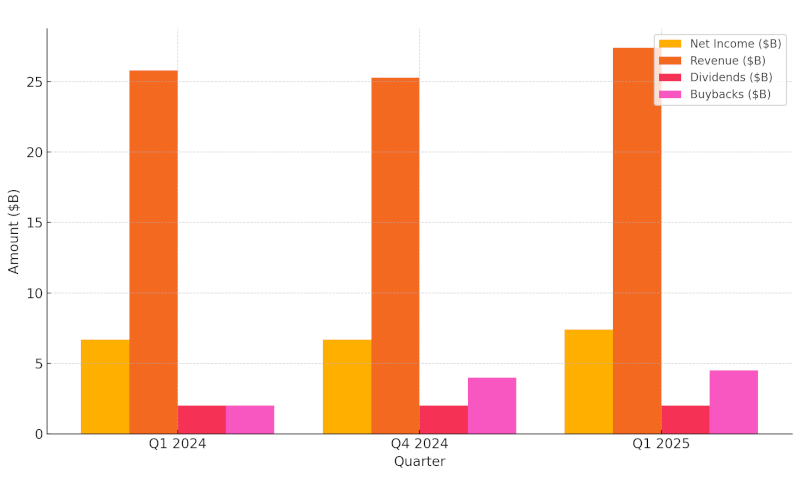

And how are we faring now, as we tilt into 2025? Quite sturdily, thank you. First quarter net income of $7.4 billion (up from $6.7B last year), and revenue rising 6% year-over-year to $27.4B, speaks to a well-balanced portfolio that’s managed to sidestep the more boorish bumps in the economy. With net interest income holding at $14.4B and every line of business tugging its weight, one feels rather reassured.

Consumer Banking continues its march—250,000 new checking accounts this quarter and $1.1 trillion in payments. Zelle remains the belle of the digital ball, and 65% of all sales are now digitally enabled. While deposit levels dipped slightly, consumer investment assets rose 9% to $498B. Good gracious, even the youths are saving!

In the realm of the affluent, Global Wealth and Investment Management has not disappointed, posting $6B in revenue and $1B in net income. Client balances now exceed $4.2 trillion. That’s trillion with a “T”, my love. Even old Rockefellers might blush.

The Global Markets division, bless their caffeinated souls, delivered their twelfth straight quarter of sales and trading growth. Record equities revenue of $2.2B suggests the lads and lasses on the trading floor are doing something right—even if it involves fewer suspenders these days.

As for their capital discipline—$6.5B returned to shareholders this quarter via dividends and buybacks, all while keeping their CET1[?] ratio well above regulatory minimums. A strong balance sheet and a steady hand? That’s Granny’s kind of bank.

And yet, one mustn’t ignore the slight uptick in credit loss provisions—now at $1.5B, with a cautious eye on consumer delinquencies. It’s a reminder, perhaps, that even a tidy parlour can conceal a cracked teacup.

Granny’s Verdict: Allocate. This is old money doing new tricks, and doing them rather well. If you're looking for a sturdy long-term cornerstone in your portfolio—something with dividends and digital muscle—Bank of America earns its place at the table.